Why China is Moving Into A Taliban-Controlled Afghanistan

the Plug #16 | On Afghan Mineral Deposits

After 20 years and US$955 billion of military and reconstruction expenses, America’s multi-decade experiment in Afghanistan has now (mostly) come to a close.

The world watched with shock and bewilderment as the Taliban surged back into power. And now, under new leadership, the future of Afghanistan remains very much in question.

Despite that uncertainty, China hasn’t missed a beat in trying to step into the power vacuum left behind by America’s departure. According to CNBC, China’s Party leader Xi Xinping may even recognize the Taliban as Afghanistan’s legitimate government.

Why is China so hastily building bridges with the Taliban?

The answer lies, in part, underneath the Afghan soil.

China is keen to capitalize on Afghanistan’s untapped wealth of mineral reserves. Some of those minerals are critically important in the construction of wind turbines, solar panels, and electric vehicles.

In theory, with China’s help, Afghanistan could help decarbonize the world.

This week’s edition has 4 sections:

🏰 Underneath the Afghan Soil

⛏️ Mineral-Intensive Emission Reductions

🚗 Powering Our Electric Vehicles

💼 A Case Study on Resource Policy

Underneath the Afghan Soil 🏰

The Taliban’s Afghan takeover has left the country in economic disarray.

Supply chains have fallen apart.

The prices of household staples (flour, oil, etc.) are skyrocketing.

Pharmacies are running out of drugs.

ATMs are flush out of cash.

Citizens are fleeing the country.

.

The Afghan economy’s return to growth will be critically important for the Taliban to maintain control of the country in years to come. To do so, developing friendships in the international community and securing foreign direct investment would be preeetty helpful for the quasi-terrorist organization.

International ties would also help the Taliban legitimize its newfound position of leadership. The Taliban has emphasized that their focus remains on developing diplomatic relationships with China.

And so, what’s the quip pro quo here?

In exchange for its support, China will expect something in return.

Minerals!

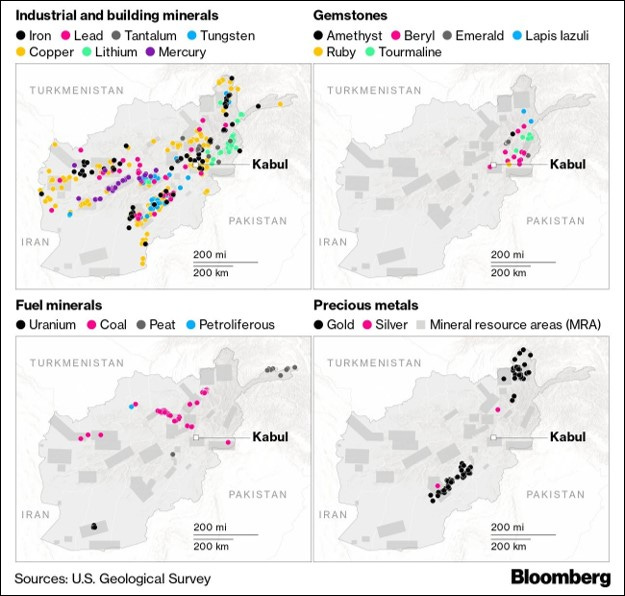

In 2010, the U.S. estimated that Afghan mineral reserves were worth ~US$1 trillion. The Afghan government suggested at the time that it may be worth three times as much.

Either way, Afghanistan’s untapped mineral reserves have a lot of potential; both economically and strategically.

It’s worth clarifying why these minerals are so important.

Mineral-Intensive Emission Reductions ⛏️

Global demand for renewable energy and electric vehicles (EVs) has risen considerably in the past decade.

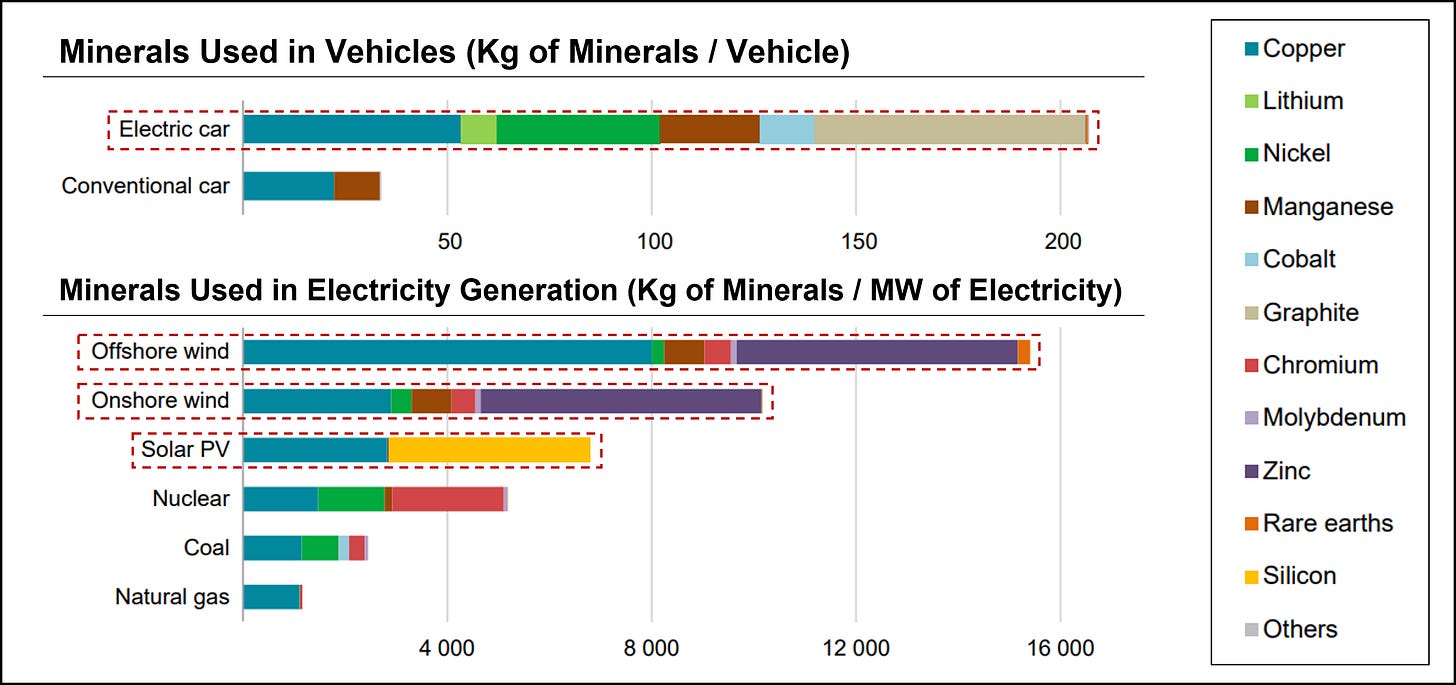

And it so happens that solar panels, wind turbines, and electric vehicles are all much more minerals-intensive than traditional alternatives.

Our focus on pursuing a green energy transition is leading to a surge in demand for certain minerals.

And as the deployment of renewable energies and the mass adoption of EVs continues to progress, demand for these key metals will only continue to rise.

For certain minerals, the unprecedented demand growth has led to questions around the long-term availability and price of supply. Without matching supply growth, the price of certain commodities could rise dramatically.

Or worse... we may just run out of some minerals altogether.

China is mindful of these possibilities. Which helps to explain its courtship of the Taliban. Laying claim on the vast reserves of Afghan minerals would serve as both an economic and strategic opportunity for China.

Western countries should beware.

Powering Our Electric Vehicles 🚗

Amongst Afghanistan’s minerals, likely the most lucrative is the country’s lithium deposits.

Lithium is a critical input for battery manufacturing. And there is real concern that absent significant new discoveries, lithium supply will fail to match the growth in lithium demand globally.

Some expect demand to begin outstripping demand as early as 2026. Which could hinder the world’s ability to continue developing rechargeable batteries at a pace that matches demand.

Not enough lithium. 👉 Not enough batteries. 👉 Not enough EVs.

Simple as that.

Should the predicted shortfall in supply become a reality, the economic and strategic value of lithium could increase substantially. In turn, paying dividends on China’s efforts to establish ties with Afghanistan.

Again, this possibility should be of concern for all countries that are not aligned with China’s vision of the future.

A Case Study on Resource Exploitation 💼

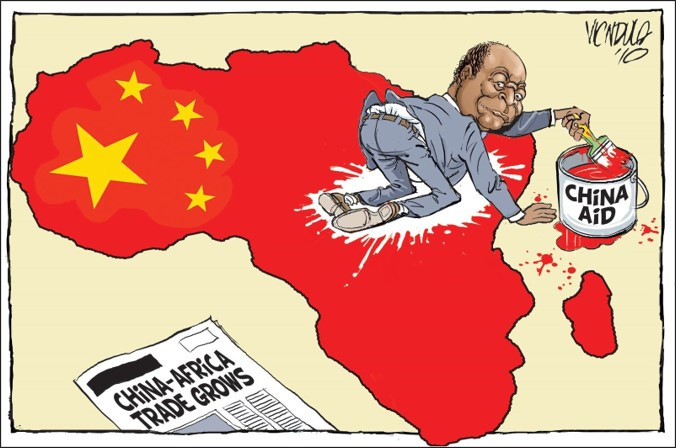

Afghanistan wouldn’t be the first country with which China has established diplomatic ties in exchange for access to critical resources.

Thanks to resource-for-infrastructure deals struck between the Democratic Republic of Congo (DRC) and China in the 1990s, China now controls ~40% of the cobalt mining capacity in the DRC.

Which may initially not seem like much.

Until you consider that the DRC controls over 50% of cobalt reserves globally, and in 2018 produced ~70% of all cobalt globally.

Chinese companies also dominate the network of middlemen who buy cobalt directly from freelance Congolese miners. As a result, much of Congo’s cobalt ends up being processed in China.

Quite the foresight by Chinese leaders.

For decades, China has been investing in the DRC by building critical infrastructure in the country. In turn, trade between the two countries (mainly in the form of mineral exports to China) has grown significantly.

In essence, China inserted itself into the cobalt supply chain through its relationship with the DRC.

That playbook could theoretically be reused with Afghan lithium reserves.

The degree to which China has established itself in the supply chains of key minerals is astounding. For each of the 5 minerals below, China has the largest processing capacity of any country globally.

China is setting itself up perfectly to be a cornerstone in green energy supply chains.

Notably, Afghanistan didn’t even make either list above. And therein lies the potential challenge for China: establishing long-term relationships with the Taliban, while building stable infrastructure, amidst volatility and conflict in Afghanistan.

A handful of U.S. politicians can certainly confirm how challenging that will be.

Will History Repeat Itself?

He who controls the supply chains of certain minerals will be in the drivers' seat throughout the multi-decade energy transition to come. Afghan mineral deposits could very well be a part of those supply chains.

But getting them out of the ground, and into green tech, will be no easy task.

Scientific and technical understanding of these resources remains at a basic, exploratory stage. Developing the infrastructure required to properly extract these resources could take years, if not decades, to complete.

Afghanistan may serve as an example of how important securing minerals will be to pursuing a green energy transition. Without these minerals, our pursuit of decarbonization may get stopped in its tracks.

China seems to understand that well enough. But the U.S.?

Maybe not so much...