“We are a fossil-fueled civilization, and we will continue to be one for decades to come as the pace of grand energy transition to new forms of energy is inherently slow.” - Vaclav Smil, Natural Gas: Fuel for the 21st Century

As I sit down to write this piece late on Sunday night, France’s election has now been called.

Emmanuel Macron has retained the French Presidency, having once again defeated right-wing candidate Marine la Pen in the Presidential run-off. Candidly, I breathed a sigh of relief upon hearing the news.

The conclusion of France’s election is important because I believe that it has set the stage for the next phase of Russian isolation. I expect this next phase to begin in short order. Specifically, with the French election behind us, the conditions are ripening for the European Commission to announce a new sanctions package against Russia; this time, on the purchase of Russian energy.

In recent weeks, European Commission President Ursula von der Leyen has advocated publicly for such an announcement, expressing that the EU is working diligently to come to an agreement on how to effectuate the forthcoming ban on Russian energy exports.

Now, with Macron safely back in the French driver's seat, there is one less barrier standing in the way of such an announcement.

A European embargo on Russian energy supply has been widely discussed in the eight weeks since the invasion of Ukraine. But, while Europe has willingly supplied the Ukrainians with Javelin anti-tank missiles, MiG-29 fighter jets, and Switchblade drones, they have failed to reach an agreement on how to execute a clean break from Russian energy supply.

In the coming weeks, I expect this to change.

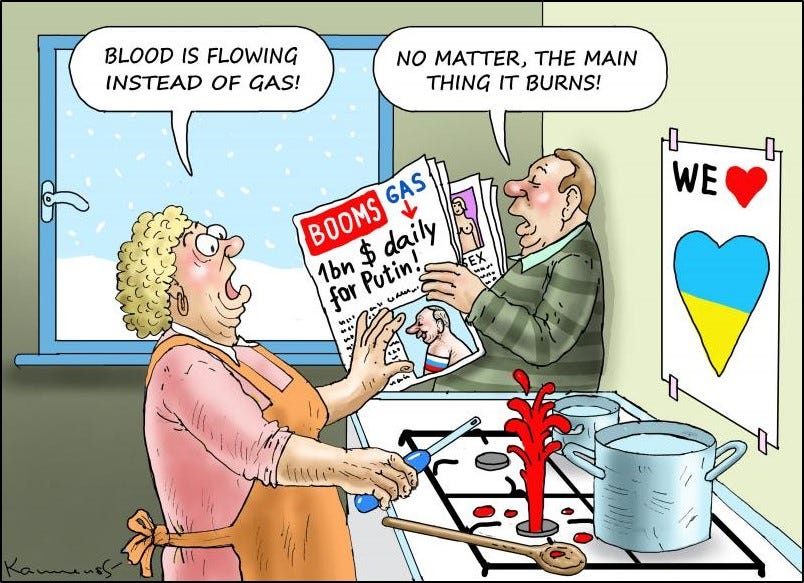

In continuing to buy Russian commodities, most notably in the form of crude oil and natural gas, Europe is directly facilitating the replenishment of Russian state coffers. And, as a result, financing the onslaught of Putin’s war machine.

One could argue that Europe is inadvertently supporting both sides in the Russia-Ukraine conflict.

That irony is not lost on Ukrainian President Vladimir Zelenskyy, who had no problem calling out the Europeans in the video below.

Given the litany of accusations levied against the Russian military by European policymakers, I see little choice but for Europe to run headlong towards the painful termination of its long-standing trading relationship with Russia.

The pain resulting from such a breakup will be felt both in Russia, and across the European continent, for years to come. Notably, given the prevailing global shortfall of fossil fuel supplies, the impact of Russia’s fraying international ties will be felt in every corner of the globe.

However, I believe that the outstanding question relating to a European embargo on Russian commodities is no longer about if, but when.

It’s time for Europe to move past bluster and rhetoric, and take tangible action to slow the advance of Putin’s military. On the back of Macron’s weekend victory, that date is drawing nearer by the day.

⛽ A Messy Breakup

It’s worth reflecting on why such an embargo has not yet taken place.

In part, the challenge facing European policymakers is the degree of economic interdependence between the European and Russian economies. Because, for three decades now, the trading relationship between the two regions has strengthened considerably.

Within that bilateral relationship, Russia has played the role of international commodity salesperson; producing and exporting the litany of key commodities on which developed economies, including each and every country that makes up the European Union, are incredibly reliant. This includes not only fossil fuels (natural gas, coal, and oil) but also other key commodities; uranium, potash, wheat, nitrogen-based fertilizer, to name but a few.

On the flip side, the Europeans have played the role of captive buyer to a relatively inexpensive and steady stream of Russian commodities.

A painless clean break is absent from the menu of options available to Europe.

And so, we should expect some pain to result from the impending economic divorce. That pain will be felt most acutely by European consumers through higher energy price inflation, and, potentially, through an inability to effectively heat their homes next winter, given the essential role that natural gas plays in heating residential homes throughout Europe.

One could be left wondering how the European Union let itself become too dependent on Russia's commodity supply. But, hindsight is 20-20.

Now, there is little to no point in crying over spilled vodka.

On balance, and with notable exception, the trading relationship between Russia and Europe had for three decades been (mostly) a win-win for both parties. This helps to explain how Russia was able to lull the EU into a sense of security.

But, Russia’s invasion of Ukraine has marked the beginning of the end of that interdependence. The impending fallout from the decoupling of the Russian and European economies will be both costly and time-consuming for both regions. And, for the global economy more broadly.

The extent to which the near-term fate of the Russian and European economies are intertwined should not be underestimated. In fact, it is the reason that Europe hasn’t been more assertive in combatting Russian aggression to date.

While the outcome of the impending economic divorce bears little similarity to the calamitous mutually assured destructed promised by nuclear war, the resulting economic consequences should also not be underestimated.

The world remains heavily dependent on fossil fuels to maintain our existing standards of living. And, in the absence of Russian fossil fuels, near-term pain will be the inevitable outcome.

❄️ Focus on the Gas

To set the stage for my ongoing coverage on this topic, I’m going to step out on a limb and make some predictions as to what I think happens next for Russian energy exports.

In future editions, I’ll revisit these predictions.

Firstly, I believe that there’s a 65% likelihood that by Sunday, May 8th, the European Union announces an embargo on Russian oil imports. As time stretches on, such an announcement is increasingly likely, and I believe that there’s a 75% likelihood that this happens by the end of May.

A related ban on Russian natural gas will be notably absent from any near-term EU sanctions package. I put the likelihood of a European ban on Russian natural gas by the end of May at only a 10% (un)likelihood.

The European calculus for replacing Russian oil versus Russian natural gas is entirely different. The task of replacing Russian natural gas imports is a much taller order than replacing oil, in part because the transportation infrastructure needed to move gas around is more technically complex and less globally interconnected than its oil equivalent.

I will expand more upon this in future editions, but for now, consider that the fungibility of oil is much greater than that of natural gas supply.

Even more interesting (and costly for European consumers and policymakers) will be the Russian response to such an announcement.

Europe has made it clear that they intend to replace Russian natural gas supply entirely by 2027, and reduce Russian natural gas imports by 65% by the end of this year. It seems unlikely to me that Putin will sit idly by and allow Europe to seamlessly transition away from its existing Russian dependence.

With the writing on the wall for all to read, I believe that Russia will counter-sanction the EU by barring natural gas exports to so-called “unfriendly countries.” Such an announcement would not be unlike recent statements from the Kremlin, dictating that the purchase of Russian energy supply must be done in Rubbles as opposed to USD and EUR (which is typically the case).

I put the likelihood that Russian natural gas stops flowing to Europe by the end of 2022 at 60%.

The outcome would be costly for Russian state revenues, albeit less expensive than the loss of revenue from European oil purchases. Such a decision would have an outsized impact on European nations, most notably Germany, where immediate pain and suffering would be felt.

The excerpt below, which sugar coats the recessionary impact on Germany’s economy from losing access to Russian gas, is from a New York Times article published last week:

“An embargo on Russian natural gas could cause Germany’s economic output to drop as much as 5 percent this year, the Bundesbank warned on Friday, potentially driving the country into a recession while pushing up already high consumer prices.”

Germany is certainly not the only country that remains dependent on Russian natural gas supply. The impact of such a decision would be felt across the EU. And, as I’ve expressed repeatedly, throughout the world given the globally interconnected nature of energy markets.

Sitting here today, I see only a handful of potential geopolitical catalysts that will have as significant of an impact on the state of world affairs as the cessation of Russian natural gas flows into Europe.

And yet, it seems to me that European policymakers are asleep at the wheel when it comes to preparing effectively for this potential (and increasingly likely) outcome.

If my predictions are correct, the consequences for Europe will be dire.

🌏 Russia’s Eastward Pivot

The impending fallout from the decoupling of the Russian and European economies will be both costly and time-consuming for both regions.

The cessation of Russian commodity imports into Europe will be a massive near-term problem for the Europeans. This challenge will be magnified next Fall as the cold winter months draw nearer. However, for the Russian economy, the loss of European buyers would be a long-term catastrophe.

That is because the sale of fossil fuels into the European continent is a key source of revenue for the Russian economy. From 2005 through 2019, Russia’s oil and natural gas industry generated ~US$2 trillion in revenue for the Kremlin’s federal budget, making up over 40% of the state’s total income.

Importantly, Europe was Russia’s main export destination. Now, Russia must scramble to find new markets.

In search of new buyers, I expect that Russia will pull a U-turn and pivot away from the West, toward the East.

Specifically, with a focus on increasing commodity exports to Asia; the region with the fasting growing energy demand on the planet. The implications for Sino-Russian relations, and the American response to increased coordination between Vladimir Putin and Xi Jinping, will be interesting to say the least.

Stay tuned for more coverage to come on this issue. The implications of Europe’s divorce from Russian energy supply, and Russia’s impending eastward pivot, will continue to impact global economics and foreign policy for years to come.

In the meantime, stay tuned for a European announcement of a Russian oil embargo. And the impending fallout in global commodity markets.

European policymakers have run out of other options.