Back in 2006, there was growing concern amongst European nations that the region was becoming too dependent on Russian natural gas. For the Russians, these concerns had the potential to cause long-term headaches.

The revenues Russia earns on natural gas exports were (and still are) an important piece of Russian GDP. And much of that revenue comes from Europe.

What was the Kremlin to do?

To address the challenge, the CEO of Gazprom (Russia’s largest gas producer) stepped onstage at the St. Petersburg International Economic Forum in 2006. His ultimatum, delivered to a mostly-European crowd, was simple:

“Get over your fear of Russia or run out of gas.”

Fifteen years later, European natural gas prices have gone parabolic. This price spike is accompanied by heightened concern amongst European nations around the possibility of running out of gas this winter.

Most media organizations have covered this story at length in recent days:

BBG: Winter Is Coming, and Europe Is Running Scarily Low on Gas(Sep-18)

FT: Europe consider $bns in aid to weather soaring gas prices(Sep-19)

WSJ: Natural-Gas Prices Surge and Winter Is Still Months Away(Sep-19)

Reuters: Gas price surge, one more headwind for the economy(Sep-20)

.

What has also resurfaced is public concern towards Russia's influence in European energy markets. As part of that concern, Russia’s nearly operational Nord Stream II gas pipeline has become a point of scrutiny.

Is Russia, in whole or in part, to blame for the fiasco unfolding in Europe right now? Or, are the Europeans simply looking for a scapegoat on which to blame rising prices?

This week’s edition has 4 sections:

🚀 What’s Driving Prices Higher?

⛽ Where does Europe get its gas?

👨🔧 An EU Pipeline Problem

🔫 Natural Gas as a Weapon

🚀 What’s Driving Prices Higher?

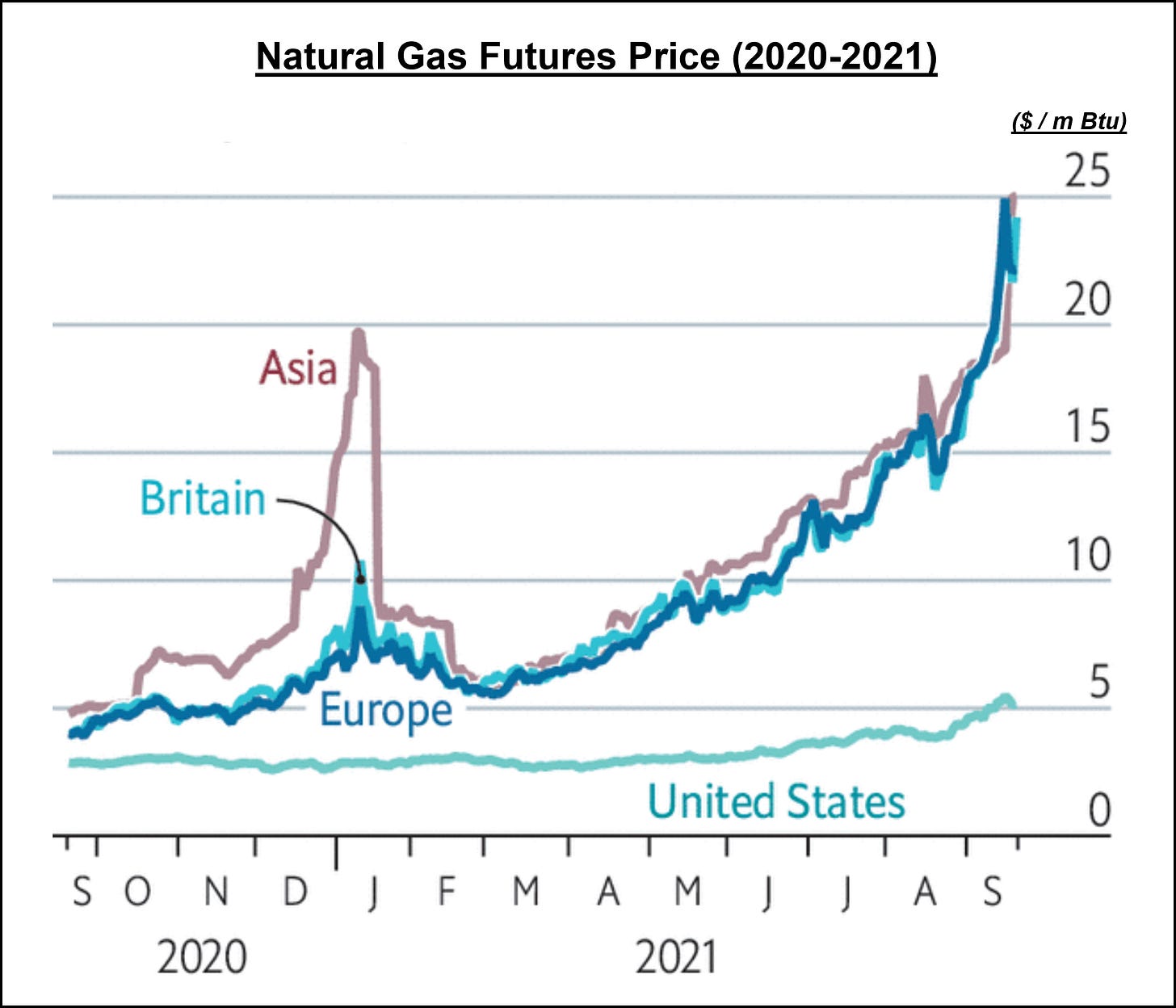

Roughly a year ago, with energy demand still in pandemic recovery mode, natural gas prices in Europe and the U.K. were below $5. At the time, there was ample global supply in the face of lower demand.

But what a difference a year can make.

Today, gas prices in both Europe and the U.K. are flirting with $25. On top of existing inflation concerns, skyrocketing energy prices are the last thing that European politicians need.

Note: This chartbook, by Reuters Analyst John Kemp, also includes a handful of interesting charts on gas and electricity prices in the U.K for anyone interested in the topic.

As I understand it, there are three main factors at play in European gas markets:

An unseasonably cold and late European winter in ‘20 / ’21 created an unexpectedly large drawdown in European gas inventories.

The global economic reopening has spurred significant growth in energy consumption broadly, including by boosting the demand for natural gas.

The weak performance of renewable energy in recent weeks has forced Europeans to rely more heavily on natural gas for electricity generation.

.

There is growing concern that, amidst a cold European winter, prices could continue to rise further. Or worse, Europe could theoretically run out of gas.

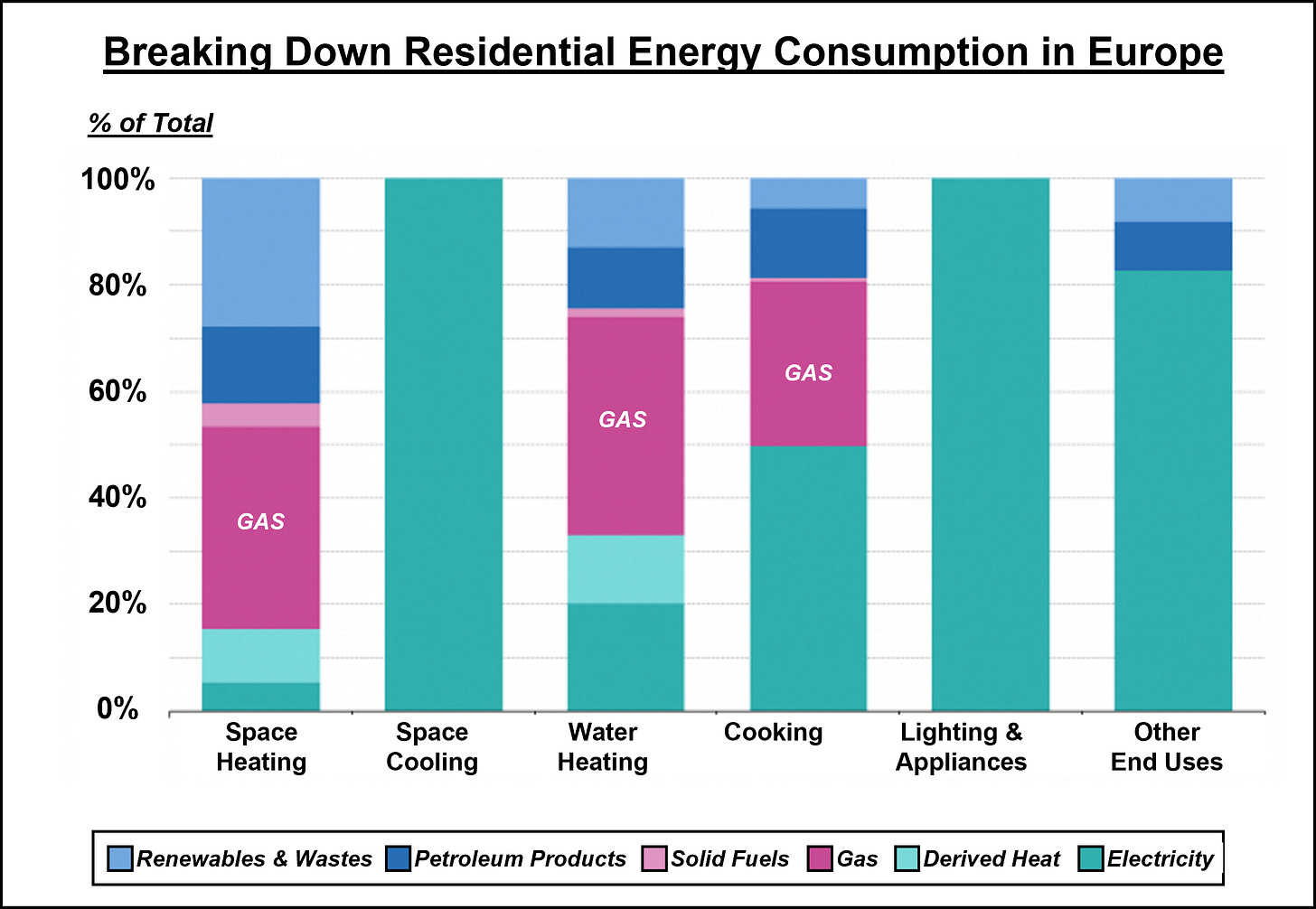

This would be a catastrophic outcome for households that rely on natural gas as a cooking and heating fuel.

The fate of Europe’s heating and cooking ability rests on the balance of weather this coming winter, as the intensity of cold winter weather plays a huge role in natural gas consumption.

In terms of national energy mixes, no two European countries are alike. And so certain countries will be hit disproportionately hard relative to others.

For example, according to a Statista survey (4,029 people) taken in the U.K. back in Mar-2021, ~87% of British respondents use natural gas as their primary home heating fuel in the winter.

If prices keep rising, a lot of Brits will not be pleased.

⛽ Where Does Europe Get Its Gas?

To solve the problem of rising prices, there are two obvious solutions: increase supply or reduce demand.

Cutting off gas demand would have a handful of negative repercussions. Increasing supply, on the other hand, would not.

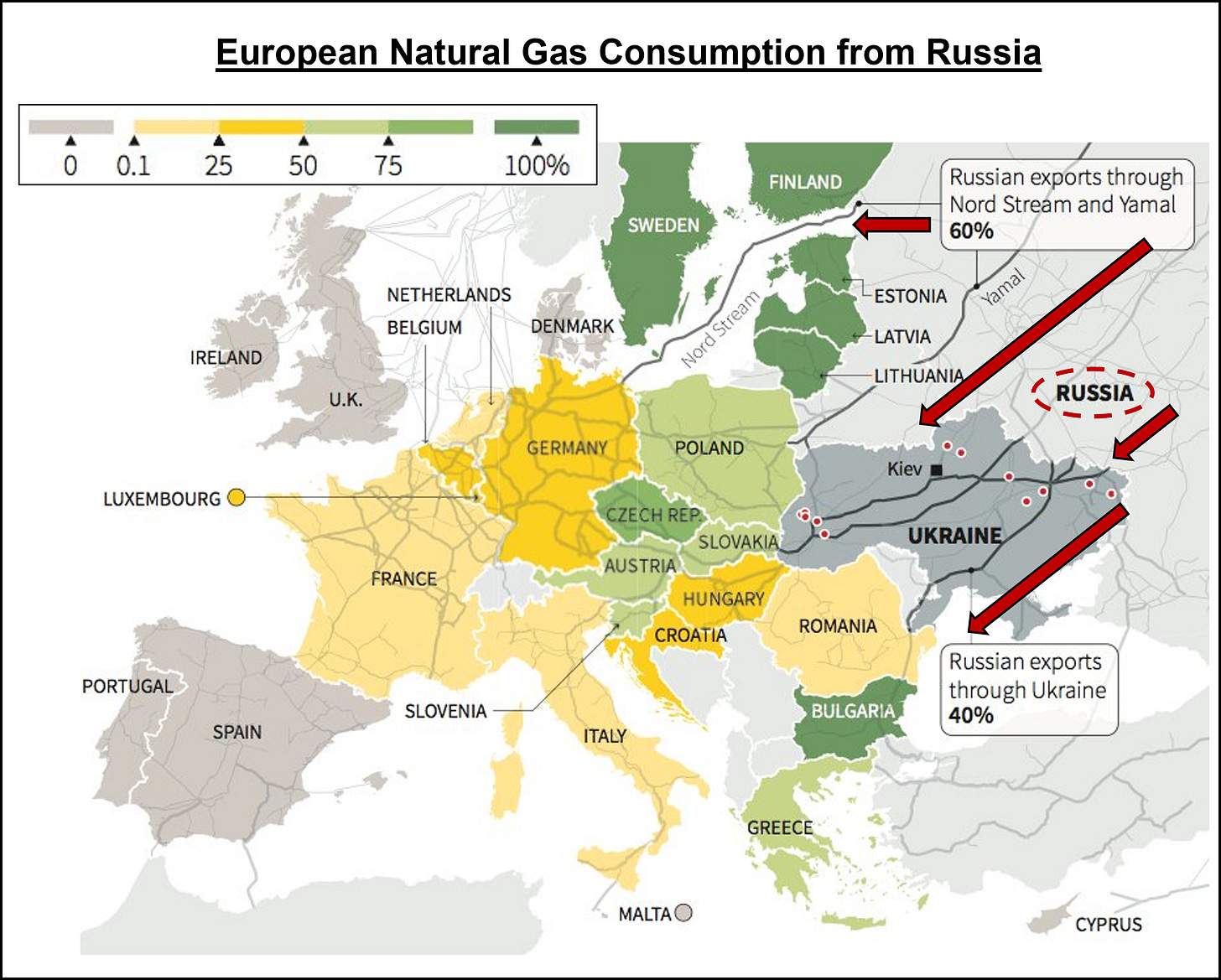

So, where does the European gas supply come from? Mostly from Mother Russia.

The chart below is dated, having been published seven years ago in 2014. But energy infrastructure changes slowly. And I’d bet that while the specific numbers have changed, the narrative remains the same.

In 2014 the following countries imported % of their total gas from Russia:

Sweden, Finland, Estonia, Latvia, Lithuania: 100%

Czech Republic: 75-100%

Poland, Greece, Austria, Slovakia: 50-75%

Germany, Croatia, Hungary: 25-50%

.

The list goes on and on. The point is that in 2014, Europe was heavily dependent on Russian natural gas.

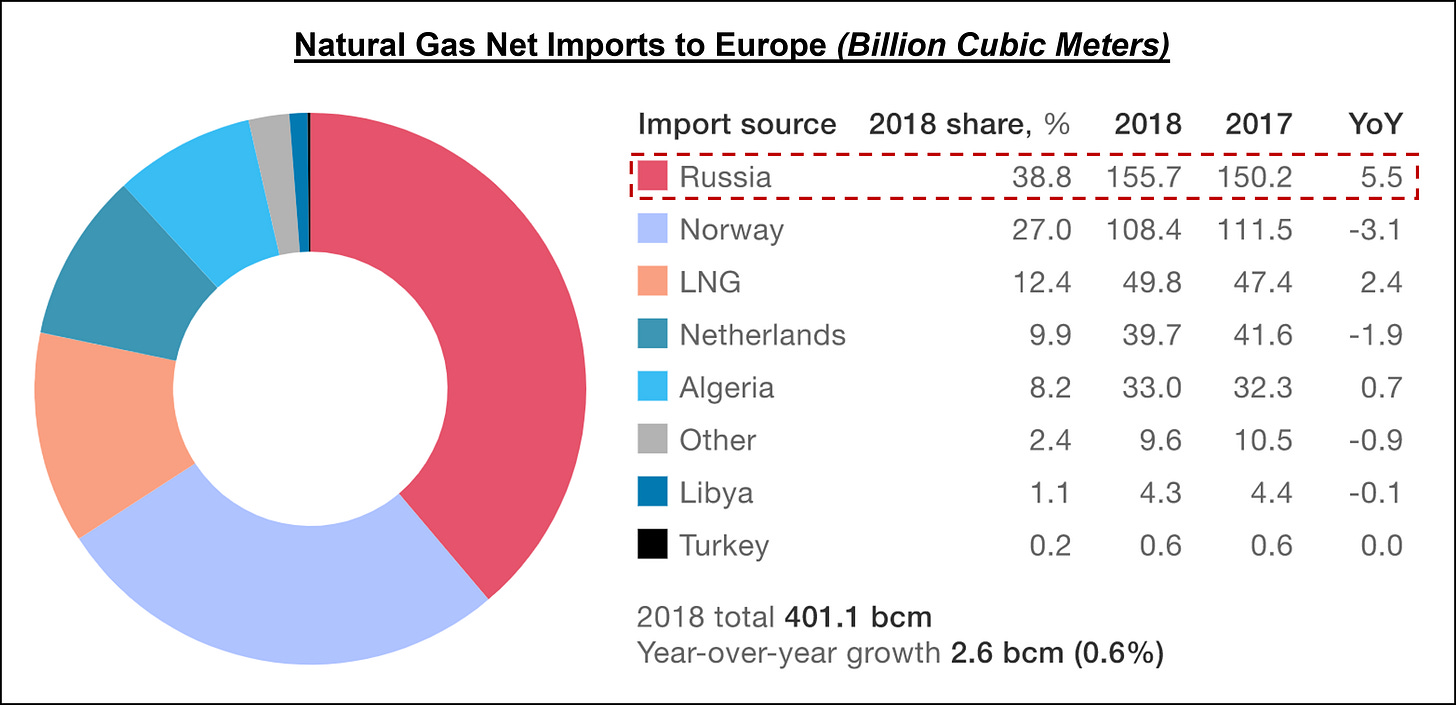

Fast forward to 2018, and Russia remained the largest natural gas supplier in Europe, representing ~39% of total natural gas imports.

If increased supply growth is what’s necessary for Europe to calm natural gas prices, then Russia seems best suited to deliver a potential solution.

It is worth noting that the growth in Liquified Natural Gas (LNG) shipments globally has, in part, helped Europe diversify its gas supplies. But these supplies don’t appear to have been sufficient to change the prevailing market dynamic between Russia and Europe.

Given Russia’s influence on European gas supply, it theoretically can drive down gas prices by increasing supply. But also... Vice versa.

Some media organizations have seized on this in recent days, accusing Russia of supplying less gas to Europe in an attempt to drive up prices. The assertion is that Russia is using its influence from its energy standing to advance its other ambitions.

The International Energy Agency (IEA) also called on Russia to pump more gas to Europe, saying the following in a statement yesterday:

"The IEA believes that Russia could do more to increase gas availability to Europe and ensure storage is filled to adequate levels in preparation for the coming winter heating season."

👨🔧 An EU Pipeline Problem

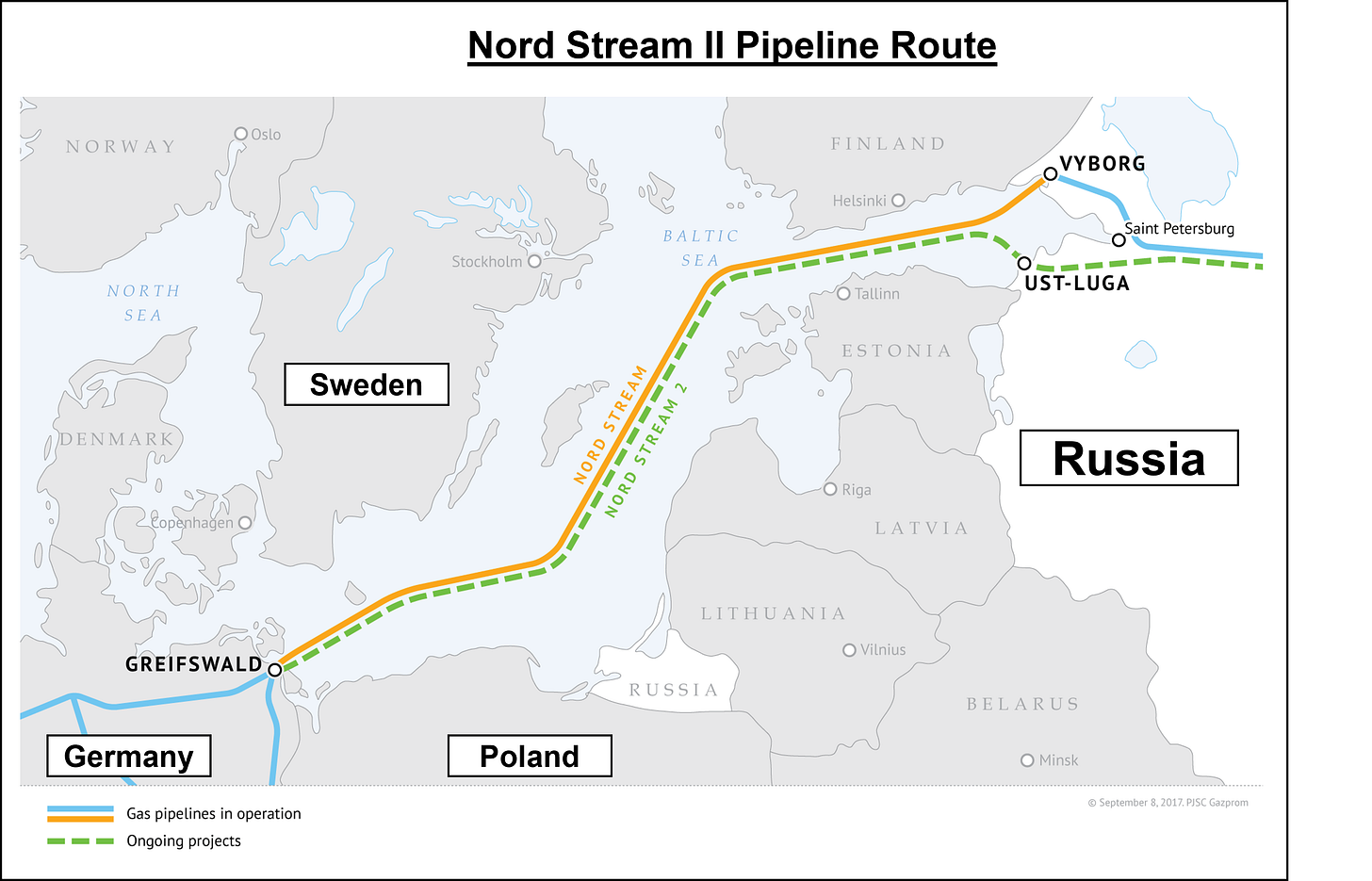

As gas prices have surged, Russia has been vocal about the role that the Nord Stream II gas pipeline could play in supplying gas to Europe.

Some have argued that the pipeline is as much a political weapon as it is a source of profit for Putin. According to the WSJ, Ukrainian President Zelensky described the pipeline as “a dangerous weapon not only for Ukraine but for all of Europe.”

The pipeline, which (according to a 2019 Polish report) likely cost somewhere between €15-20bn, would run directly from Russia and Germany.

The suspicion arising in Europe is that Russia is trying to accelerate the approval and startup of Nord Stream II, using rising gas prices as a political football. The deadline for certification is currently set as January 2022. Moscow, however, wants to move up that timeline and has stated that it’s ready to start shipping gas almost immediately.

Leave it to the Kremlin to try and capitalize on a crisis.

Given the hostility between Ukraine and Russia in the past decade and the role that Nord Stream II would play in bypassing Ukraine, it should come as no surprise that Ukraine (and other European countries) are not supportive of the project.

Contrarily, supporters of the pipeline justify growing ties with Russia by explaining that the Russians are more dependent on revenue from natural gas exports than Europeans are on the supply.

At this point, the pipeline will certainly be completed. The only question remaining is when that will be.

🔫 Gas as a Weapon

This story will continue to evolve as the weather turns colder in the coming months. The operationalization of Nord Stream II will also be interested to watch.

Hopefully, this has served as a helpful introduction to the topic.

Europe should be rightfully concerned about the recent energy price spike. This scenario highlights the importance of maintaining secure and affordable energy supplies. As the world continues to decarbonize, and restrictions are placed on certain fuels, I expect that price spikes like this one will continue to increase in frequency and magnitude.

In the meantime, it’s worth keeping an eye on what the Russians do next. Will they use their position of strength in energy markets as a political weapon? And how high will energy prices go in Europe?

Only time will tell.