A Bill Gates Approach to Decarbonization

the Plug #23 | Breakthrough Energy’s Catalyst Program

“My basic optimism about climate change comes from my belief in innovation. The conditions have never been more clear for backing energy breakthroughs. It’s our power to invent that makes me hopeful.” – Bill Gates

Earlier this year, I picked up Bill Gate’s highly touted book ‘How to Avoid a Climate Disaster.’

For anyone who wants to better understand the intersection between our energy system and climate change, regardless of prior knowledge or understanding, I’d highly recommend it checking it out.

In Gate’s writing, what stood out for me was the pragmatism he maintains while addressing the challenges the world faces today in our pursuit of decarbonization.

As I see it, these primary challenges are threefold:

Climate Change: Mitigating the worst impacts of anthropogenic climate change will require a coordinated global effort to decarbonize our energy system at unprecedented speed and scale

Energy Emissions: Today’s energy system, which is the bedrock of our economies and our societies, is highly carbon-intensive; but it’s also efficient, reliable and inexpensive – three characteristics that are now expected as the norm

Energy Poverty: Much of the developing world still doesn’t have reliable access to energy supply; given the correlation between wealth and energy access, the demand for cheap, reliable energy will grow tremendously in the coming decades

At times, I’ve found these competing challenges overwhelming. But there’s a sense of optimism in how Gates describes the path forward.

Gates’ belief in the human ability to innovate and adapt is contagious. His hopefulness is refreshing amidst the dramatic, apocalyptic rhetoric that has become standard issue in reporting and literature on energy and climate change.

Rome wasn’t built in a day. The road to decarbonization will be similarly long and winding.

This week’s edition of the Plug has four sections:

🔋 A Breakthrough in Energy

☀️ Solar Energy’s Feedback Loop

💡 The World Needs Some Catalysts

🐘 An Elephant in the Room

🔋 A Breakthrough in Energy

Focusing exclusively on Bill Gates’ penmanship would vastly undersell the totality of his work on decarbonization. Gates’ efforts and philanthropy extend well beyond his recently published book.

In 2015, alongside a coalition of private investors, Gates’ established Breakthrough Energy (BE). The firm’s objective is to help lead the world to Net Zero emissions by 2050. The overlap between the message in Gate’s book, and BE’s mission, is immediately apparent upon visiting its website.

The firm has three main functions:

Supporting cutting-edge research and development

Investing in companies turning green ideas into clean products & tools

Advocating for policies that speed innovation from lab to market

.

Since its inception, the firm has become increasingly active on all three fronts.

Earlier this year, the company made an exciting announcement. It’s launching a new initiative called Catalyst, an innovative investment vehicle that combines early-stage financing with philanthropy.

As Larry Fink describes it, Catalyst “is not just a venture fund. This is really about using philanthropic money or using capital that would be below market rate capital, to try to accelerate a private-sector solution alongside the government.”

The interview below, produced by Bloomberg Green, includes a deep dive into the program’s formation and its objectives going forward.

Seven companies co-founded the Catalyst program: Microsoft, Blackrock, Bank of America, American Airlines, ArcelorMittal, Boston Consulting Group, and General Motors. Notably, each one hails from a different industry.

As I understand it, Catalyst’s objective is kind of similar to a loss-leader strategy.

Loss leadership is the process of selling a specific product for less than cost (i.e. at a loss) to incentivize the sale of another related product. One example being the sale of low-cost computer printers that require expensive ink cartridges to function.

In Catalyst’s case, the program seeks to invest in technologies with high decarbonization potential, but that may yield below-market (or even non-existent) near-term returns. They are essentially investing in expensive computer printer manufacturing to bring down the cost of computer printer manufacturing for everyone else.

In doing so, Catalyst hopes to make it more attractive for other companies to deploy investment dollars into four key industries further down the road.

It’s a counterintuitive proposition in our return-hungry, capitalistic society.

☀️ Solar Energy’s Feedback Loop

To illustrate what Catalyst is trying to do, it’s worth revisiting the last few decades of progress in the solar energy industry.

Solar energy is ubiquitous today; on our rooves, in the news, and within government policy initiatives. But when Jimmy Carter installed solar panels on the roof of the White House in 1979, that was certainly not the case.

What changed since then?

One of the main factors is that the world built a lot of solar panels. Year after year, the supply chains that produce and distribute solar panels became more efficient. Along the way, we learned from our mistakes and tweaked the processes.

The outcome was massive reductions in solar energy costs. Today, under certain conditions, solar energy is cost-competitive with carbon-intensive fossil fuel alternatives.

One way to understand solar energy’s cost declines is by quickly brushing up on Wright’s Law.

Wright’s law states that every doubling of cumulative production results in a fixed percentage decline in a technology’s cost. The more we build, the better we become at building. And as a result, costs decline steadily over time.

There’s also a positive feedback loop involved in that process: cheaper technology leads to more investment and wider-spread adoption, leading to additional manufacturing and further cost reductions.

For anyone familiar with S-curves, that cycle may be intuitive.

Another way to understand solar cost reductions is through the lens of efficiency improvements, or growth in electricity output per dollar spent. If each incremental dollar of investment yields more electricity output than the last, the cost of electricity must be going down.

According to the IEA, from 2010 through 2020, investment in solar energy (dark green below) saw only modest growth. But, at the same time, the resulting electricity output from installed solar panels exploded.

Today, the world is reaping the decarbonization benefits of replacing fossil-fuel-fired electricity generators with cost-competitive solar panels. The progress achieved to date in the solar energy space is remarkable.

But achieving cost parity took decades of innovation and investment.

The concern that now exists surrounds the long road to cost-competitiveness for the next generation of decarbonization technologies. Especially those outside of the electricity sector.

The world needed these decarbonization technologies yesterday. Not ten years from now. Rapid decarbonization across industries is critical to mitigate the worst impacts of climate change. And the longer it takes for new decarbonization technologies to become cost competitive, the worse the impacts of climate change will become.

So, how to speed up those timelines?

💡 The World Needs Some Catalysts

The Catalyst program focuses on four technologies with massive long-term decarbonization potential. Each one, however, is currently too expensive for widespread adoption to take place anytime soon.

The four areas on which Catalyst focuses are:

Green Hydrogen: Producing carbon-free fuel from renewable energy

Carbon Capture: Removing CO2 directly from the atmosphere

Aviation Biofuel: Decarbonizing air travel

Energy Storage: Building larger and longer-duration batteries

These four technologies remain too nascent (and expensive) to justify investment for most investors. In Bill Gates’ terminology: a materially large Green Premium remains. But as we saw with solar energy, early investment is needed to begin driving down costs.

And that’s where the Catalyst program comes into play.

Catalyst revisited the last several decades of progress in solar energy to highlight their objective. And what that timeline could have looked like with the support of a Catalyst-style program.

Catalyst’s objectives can be summed up in two short bullets:

Accelerate cost reduction through early investment

Increase the speed of market adoption, and in turn, decarbonization

🐘 An Elephant in the Room

It is worth noting that amidst Catalyst’s philanthropic ambitions, there is also an elephant in the room.

As the world strives to achieve Net Zero goals through 2050, there will be companies that emerge as winners in that transition. The demand for key technologies will be in increasingly high demand. In turn, the valuations surrounding those companies will rise.

For investors that have the foresight (and luck) to invest early on in certain companies, the opportunities for outsized returns and profit are, and will continue to be, tremendous. Given the Catalyst program’s early investment in these four industries, there is a possibility that in the long-run, the program yields material returns.

That much is just a reality of the world we live in. But, it’s worth reiterating that long-run profit potential doesn’t seem to be Catalyst’s primary motivator.

Regardless of the long-term outcomes that result from the Catalyst program, I’m optimistic about the leadership role Breakthrough Energy is taking in decarbonization.

Somebody has to step up to the plate…

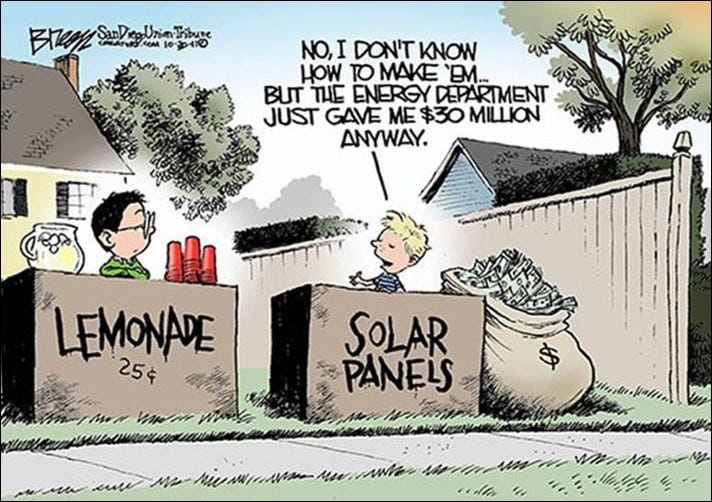

Amd hopefully, with Bill Gates leading the decarbonization charge, there won’t be too much government funding wasted along the way.